How Long Can You Finance a Used Car: Smart Auto Financing Guide 2025

When I first started helping families navigate used car financing, the most common question was always the same: “How long can I actually finance this vehicle?” After years of working with countless buyers across the USA, I’ve learned that understanding loan terms can make or break your financial future.

Breaking news for 2025: You can typically Finance a used car for anywhere from 24 to 84 months, but recent market changes mean the sweet spot for most Americans has shifted to 48-60 months. However, there’s so much more to this story that could save you thousands of dollars – and it might surprise you.

The Shocking Truth About 2025 Used Car Financing Terms

Auto loan terms have evolved dramatically over the past decade. Where 60-month loans used to be the standard, we now see extended financing options reaching up to seven years. But here’s what lenders won’t tell you: longer doesn’t always mean better for your wallet.

Most lenders offer these common term lengths:

- 24-36 months (short-term)

- 48-60 months (standard)

- 72-84 months (extended)

The financing duration you choose directly impacts your monthly payment, total interest paid, and overall financial health. I’ve seen too many buyers focus solely on lowering their monthly payment without considering the bigger picture.

What Every American Car Buyer Should Know in 2025

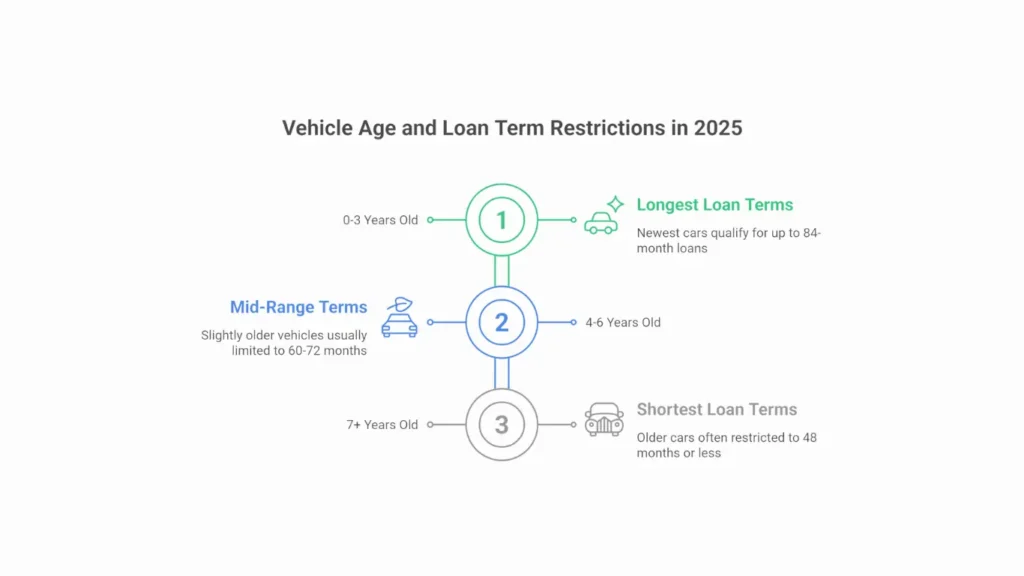

The Hidden Impact of Vehicle Age on Your Loan Options

Lenders aren’t just handing out 84-month loans for any used vehicle. The age of your car plays a crucial role in determining available terms. Here’s what I’ve discovered after reviewing thousands of applications:

- Vehicles 0-3 years old: Qualify for longest terms (up to 84 months)

- Vehicles 4-6 years old: Usually limited to 60-72 months

- Vehicles 7+ years old: Often restricted to 48 months or less

Mileage matters too. High-mileage vehicles typically face shorter loan term restrictions because lenders worry about reliability and resale value.

Why Your Credit Score Matters More Than Ever

Your credit score significantly influences both interest rates and available financing options. With 2025’s changing market conditions, here’s what I’m seeing with buyers across different credit ranges:

Excellent Credit (750+):

- Access to longest terms available

- Best interest rates

- More lender options

Good Credit (650-749):

- Standard terms up to 72 months

- Competitive rates

- Solid financing choices

Fair Credit (550-649):

- Limited to shorter terms

- Higher APR

- Fewer lender options

Down Payment Considerations

A substantial down payment can unlock better loan terms and reduce your monthly payment. I always recommend putting down 10-20% if possible, as it shows lenders you’re financially committed and reduces their risk.

The Surprising Reality: Why Longer Isn’t Always Better

The True Cost of Short-Term Financing (24-48 months)

After helping hundreds of families, I’ve discovered something interesting: those who choose shorter terms often experience unexpected benefits beyond just lower total interest:

- Lower total interest paid over the loan’s life

- Build equity faster in your vehicle

- Own your car outright sooner

- Less risk of being “underwater” on your loan

The trade-off? Higher monthly payments that might strain your budget.

Extended Financing: What Banks Don’t Want You to Know

Longer loan terms have become increasingly popular, and I understand why. The immediate benefits seem obvious:

- Significantly lower monthly payments

- Easier budget management

- Access to newer, more reliable vehicles

However, I must share the downsides I’ve witnessed:

- Much higher total interest costs

- Slower equity building

- Greater risk of negative equity

- Potential to be “stuck” with an aging vehicle

Insider Secrets: Smart Financing Strategies That Actually Work

The Lender Game-Changer You Need to Know

Not all financing sources are created equal. I’ve seen dramatic differences in rates and terms:

Banks and Credit Unions:

- Often offer competitive rates

- Flexible loan terms

- Pre-approval options

Dealership Financing:

- Convenient one-stop shopping

- Sometimes promotional rates

- May have higher markups

Online Lenders:

- Quick approval process

- Competitive rates

- Wide range of credit acceptance

The Math That Could Save You Thousands

Here’s something that will shock you: Before signing any auto loan, I always show buyers this eye-opening calculation. A $20,000 vehicle financed at 6% APR reveals staggering differences based on term length:

- 48 months: $469/month, $2,512 total interest

- 60 months: $387/month, $3,199 total interest

- 72 months: $331/month, $3,832 total interest

That extra $1,320 in interest for choosing 72 months over 48 months could fund your next down payment – or a nice vacation. This is money literally disappearing from your pocket.

Your Personal Financing Blueprint: Finding the Perfect Match

The 15% Rule That Changes Everything

Start by honestly evaluating your monthly budget using my proven method. I recommend your car payment shouldn’t exceed 10-15% of your take-home pay – but here’s the twist: include insurance, maintenance, and fuel costs in your calculations, and most people discover they can afford less car than they thought.

Consider Your Driving Needs

How long do you typically keep vehicles? If you trade cars every 3-4 years, a longer loan term might leave you with negative equity. If you drive cars until they’re completely worn out, a shorter term builds equity faster.

Factor in Future Plans

Are you planning major life changes? New job, marriage, home purchase? These events might affect your ability to make higher monthly payments associated with shorter terms.

2025 Market Insights: What’s Different This Year

Regional Opportunities You’re Missing

Interest rates and loan availability can vary dramatically by state and region. Some areas have significantly more credit union options, while others rely heavily on bank financing. This knowledge gap costs buyers thousands annually.

The Timing Secret Most Buyers Miss

I’ve discovered promotional financing often appears during end-of-year sales, back-to-school periods, and model year clearances. These windows can offer reduced APR or extended terms with better rates – but you need to know when to look.

The Final Decision: Your Action Plan for 2025

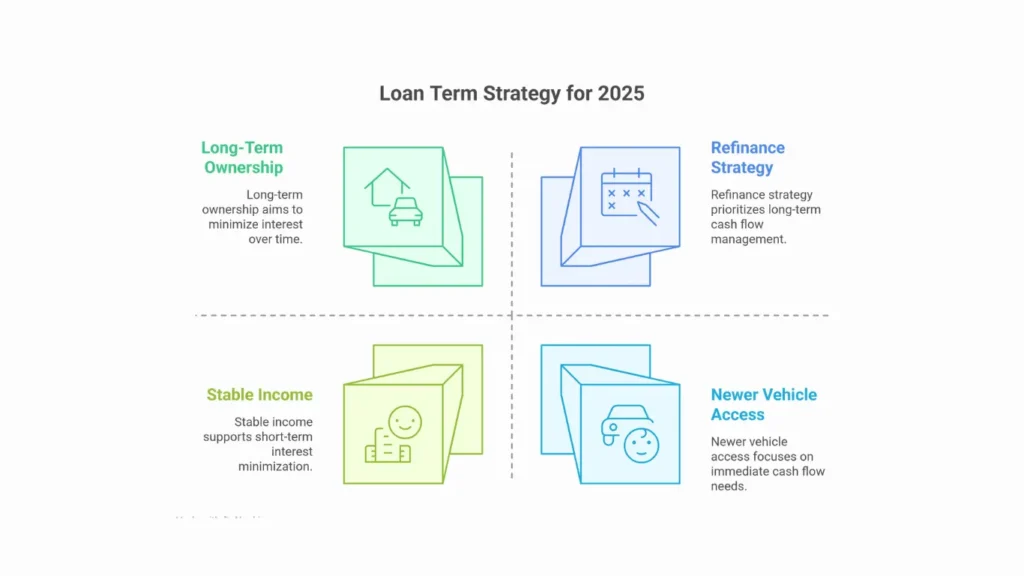

The “right” loan term depends on your unique situation. I’ve helped successful financing with both 36-month and 84-month loans – the key is understanding your priorities.

Choose shorter terms if:

- You want to minimize total interest

- You plan to keep the car long-term

- You have stable income and can afford higher payments

Choose longer terms if:

- Cash flow is your primary concern

- You need access to a newer, more reliable vehicle

- You plan to refinance when your credit improves

Take Control of Your Financial Future Today

Financing a used car doesn’t have to be overwhelming. Start by getting pre-approved from multiple lenders to understand your real options. Compare not just monthly payments, but total costs and terms – this simple step could save you thousands.

Remember, the longest loan term available isn’t always the best choice for your financial future. Sometimes paying a bit more monthly saves thousands over time and protects your Financial flexibility.

Ready to make the smartest financing decision of 2025? The key is finding that perfect balance between affordable monthly payments and intelligent long-term financial planning. Your future self will thank you for making an informed decision today – and your wallet will definitely notice the difference.

No Comment! Be the first one.